CLOUD

Loan Servicing on the Cloud

Get It Done With Us

The subscription-based software-as-a-service (SAAS) solution for loan servicing. Our platform is designed to make loan management more efficient and convenient for lenders.

Multiple Interest Calculation Methods

SYNDi Cloud has four types of interest calculation methods you could choose from to setup your loans. They are 360 Day Year, 365 Day Year, Exact Year and 12 Month Year.

Field Customization

SYNDi Cloud is a parameter-driven software. It has the ability to define an unlimited number of optional fields. This allows you to customize the application to suit your business requirements. Once these fields have been setup, you can go back to add, remove or edit changes to these fields as your business requirement changes while your business grows.

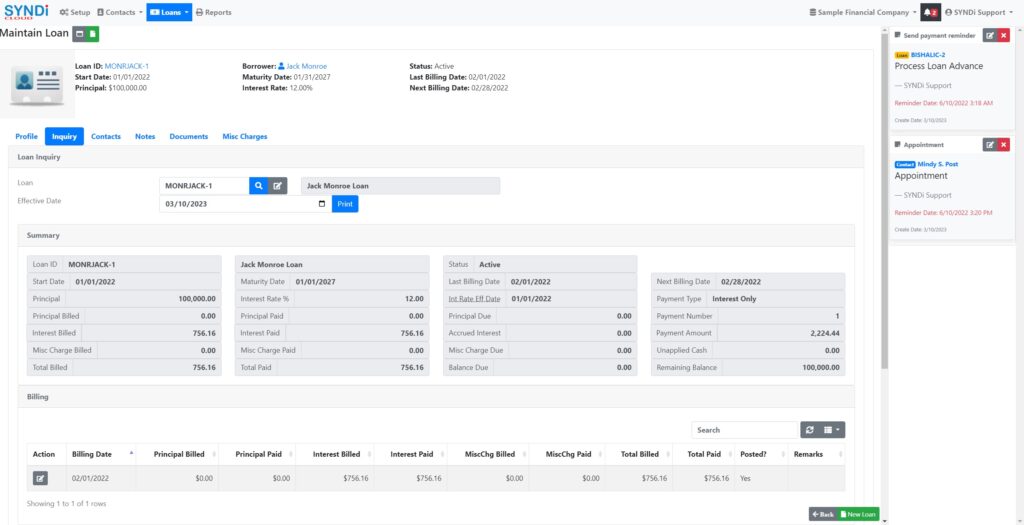

Real-time Reporting

SYNDi Cloud allows you to monitor your books in real-time through on-line inquiries and timely reports. Borrower statements can be generated. Detailed or consolidated reports can be generated for entries in General Ledger.

Billing Frequency

SYNDi Cloud can manage your loan billing cycle using one of the following billing frequency available. Weekly, bi-weekly, semi-monthly, monthly, bi-monthly, quarterly, semi-annual or annual.

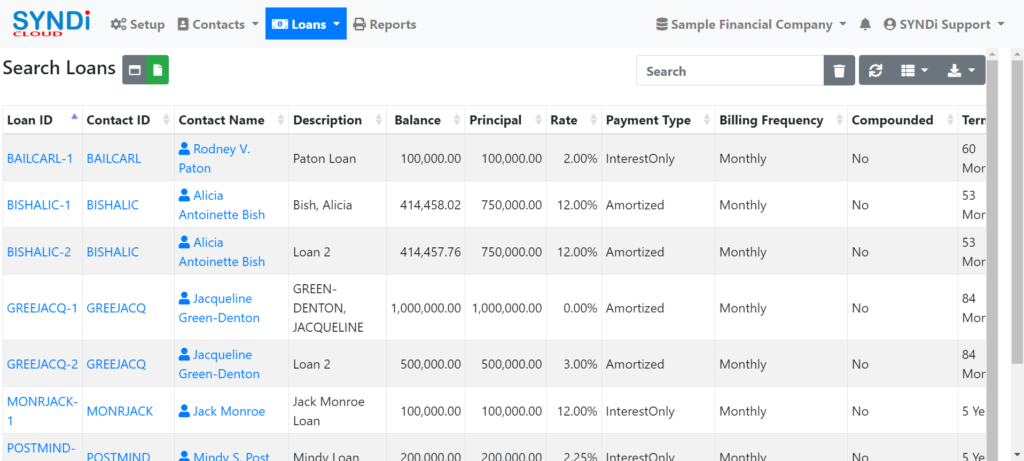

Friendly User Interface

SYNDi Cloud has a friendly user interface to view and manage your Loans. Our screens have been designed to be uncluttered, and display only what you need.

Interest and Payment Types

SYNDi Cloud has a variety of interest and payment types you can use to setup a Loan like Interest-only loans, interest-free loans, blended or interest only payments, fixed or variable interest rates, simple or compounded interest.

Loan Terms Renegotiation

During the life of a loan, terms can be renegotiated at anytime.

Loan Documents

SYNDi Cloud can help you manage and catalog loan documents for each loan.

NSF Charge Calculation

NSF Charges can be calculated on returned borrower checks.

Reminder Alerts

SYNDi Cloud has a built in reminder system that can display onscreen alerts so that you will always be on top of things.

Amortization Tables

Amortization tables can be generated based on a loan profile.

User Profiles

SYNDi Cloud has the ability to setup user profiles based on what functions you want the user to be able to perform and see.

Printing Cheques

SYNDi Cloud has the ability to print cheques.

Adapts industry changes

A key feature of SYNDi Cloud is the ability to manage both interest-only and amortized loans, with fixed or variable interest rates, and flexible amortization/accrual intervals. This flexibility allows you to easily manage a wide range of loan types and meet the specific needs of your borrowers.

Customer Support

We’re dedicated to providing our customers with the best loan servicing software available, and our support team is always available to assist you with any questions or issues you may have.

Loan Servicing Process Doesn’t Have to Be Hard.

Eliminates elaborate Excel worksheets by embracing a wide range of features designed help you streamline your loan servicing process. Run automated amortization, interest accruals across all loans, make loan inquiries, receipt entries, and generate listings, and analytic reports with just a few clicks are just a few of the features that make SYNDi Cloud the ideal choice for loan servicing software.

Corporate Head Office

SYNDi Group

INDUSFLOW SYSTEMS INC.

2800 14th Avenue, Suite 405

Markham, Ontario L3R 0E4

Canada

Caribbean Office

SYNDi Group

INDUSFLOW SYSTEMS INC.

38 John Street

Montrose, Chaguanas

Trinidad & Tobago

Phone Numbers

Toronto Area: 905-940-0751

Canada and USA: 1-888-940-0751

Outside North America: +1 905-940-0751

Monday to Friday, 9:00 a.m. to 5:00 p.m. EST

Emails

General Inquiry: info@syndi.ca

Technical Support: support@syndi.ca