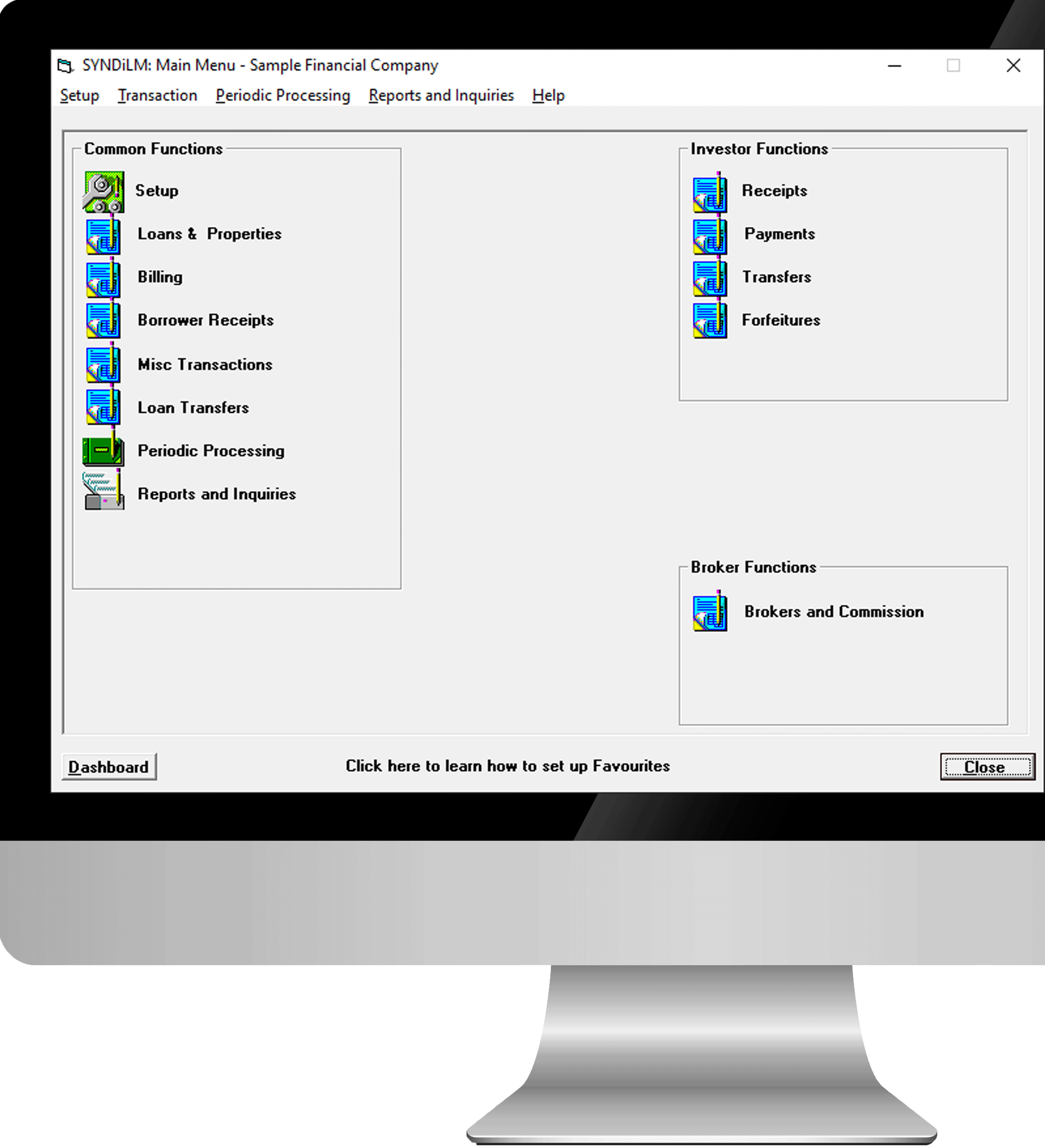

Administer Syndicated Mortgages

SYNDi Mortgage Manager streamlines every function in mortgage administration. It manages investor receipts and payments, provides timely statements and reports, and facilitates investor relations.

What is  Mortgage Manager ?

Mortgage Manager ?

SYNDi Mortgage Manager services residential or commercial mortgages and construction loans funded by a single or a group of private lenders. You can set up the mortgage, receive lenders’ contributions, fund the mortgage,, collect installment from the borrower and distribute it to lenders.

How can  Mortgage Manager help?

Mortgage Manager help?

The primary benefit of SYNDi Mortgage Manager is to inculcate better lender relations by providing timely reports and statements, which can be emailed to them directly from SYNDi. The system tracks missed payments, processes returned checks and creates accounting entries which can be exported to your accounting software, such as Sage 300 ERP (Accpac). You may also link mortgage loans to real-estate properties and calculate Loan-To-Value Ratios. SYNDi will calculate their commissions and generate broker statements and reports if you work through brokers and agents. If funds are released to the borrower progressively, e.g., in Construction Loans, SYNDi can quickly process them and generate FSRA documents. The SYNDi Document Library can be used to maintain legal records related to each mortgage.

Product Features

Syndicated Mortgages

SYNDi Mortgage Manager allows you to keep track of syndicated Mortgages where two or more lenders can participate in a mortgage against a property.

Flexible Rates

The interest rate may be fixed or variable with a floor. t is also possible to maintain an interest differential between borrowers and lenders.

Flexible Terms

The mortgage could be set up as interest-only or amortized. You may also enter a fixed amount of principal to be paid by the borrower every month.

Broker/Agent Commission

SYNDi Mortgage Manager can calculate Broker/Agent Commissions.

Billing Frequency

Calculate the borrower instalment on a weekly, bi-weekly, semi-monthly, monthly, bi-monthly, quarterly, semi-annual or annual basis.

Direct Deposits and Payments

SYNDi EFT module will enable you to receive borrower installments through pre-authorized payments and pay lenders through direct deposits into their bank accounts,

Multiple Interest Calculation Methods

SYNDi provides the option to choose from four methods of interest calculation: 360-Day Year, 365-Day Year, Exact-Year and 12-Month Year.

Interest Reserve

You may set up prepaid interest as interest reserve for high-risk mortgages, track cumulative deficit and top it up if necessary..

Loan Documents

SYNDi fills out FSRA’s lender Disclosure, Construction Addendum and other prescribed Loan Documents, which can be emailed to lenders directly from SYNDi..

Payment Reversal

When a payment from a borrower is returned by the bank for any reason, it can be reversed, in which case SYNDi applies NSF Charge, prepares a notice to the borrower and generates a reminder to the user.

Property Details

Detailed information about the real estate property, such as zoning, appraisal, prior encumbrances, etc., can be entered in SYNDi to disclose to lenders.

Amortization Schedules

SYNDi generates Amortization Schedules based on the loan profile.

Investor Transfers

A lender can withdraw all or a portion of the principal during the term and be replaced by another lender. Part of the principal and interest can be forfeited due to early withdrawal.

Non-Resident Tax

You can flag a lender as a foreigner, in which case SYNDi will withhold Non-Resident Tax and remit it to the tax agency.

Annual T5 Slips

SYNDi prepares annual T5 slips for reporting interest income, emails them to lenders, and uploads the information to CRA.

Pop-up Reminders

SYNDi has a built-in reminder system that can display onscreen alerts so that you will always be on top of things. These reminders pop up at specified intervals of time.

Time-Sensitive Reports

You can generate reports related to borrowers, lenders and brokers as of the specified date. Online inquiries yield real-time information to keep you up-to-date. Some statements can also be generated to print and mail out or email.

Microsoft Office Integration

Any information from SYNDi can be imported or linked to any module in Microsoft Office. This facilitates MailMerge with Microsoft Word documents. All reports are generated in Microsoft Excel and can be saved, massaged, or resorted.

Open Database

The most suitable database for SYNDi is Microsoft SQL Server. However, customers with low volume of data can get by with Microsoft Access.

Unlimited Optional Fields

You can define an unlimited number of optional fields for borrowers, lenders and loans. This enables you to customize the application to suit your business requirements.

User Profiles

You may set up user profiles based on what functions you want a user to be able to perform. You may set up user rights for every function to display / add / change / delete a record.

Sage 300 Integration

SYNDi Mortgage Manager can be optionally integrated with the latest Sage 300 (Accpac).

Printing Checks

Checks can be printed for borrowers, lenders and other parties such a insurance companies and tax agencies.

Multiple Advances

If a loan requires multiple advances SYNDi allows this at anytime during the loan. Each advance increases the principal of the loan by the total amount advanced.

Categorize Lenders

Lenders can be classified as of A and B lenders. This classification can be used for furthur customization.

Market to Lenders

You can advertise new deals to lenders and collect online commitments.

SYNDi Web

SYNDi Web Portal allows lenders online access to query their account.

Registered Investments

Setup and Manage trustees for registered investments.